Fineotex Chemical Limited is a leading manufacturer of specialty chemicals used in various industries such as textiles, construction, agriculture, and personal care. For investors and traders interested in analyzing Fineotex Chemical share price trends, it is crucial to understand the various factors that can impact the stock price movement. In this comprehensive guide, we will delve into the key aspects of analyzing Fineotex Chemical share prices, including fundamental analysis, technical analysis, and market trends.

Fundamental Analysis of Fineotex Chemical Share Price Trends

Fundamental analysis involves assessing a company’s financial health, management quality, growth prospects, and industry trends to determine the intrinsic value of its stock. When analyzing Fineotex Chemical share prices from a fundamental perspective, consider the following factors:

1. Revenue and Profitability

- Evaluate the company’s revenue growth trajectory over the past few years.

- Analyze the profit margins to gauge the company’s efficiency in generating profits.

2. Balance Sheet Strength

- Review the company’s debt levels and liquidity position.

- Assess the asset quality and liabilities to ascertain financial stability.

3. Market Position and Competitors

- Study Fineotex Chemical’s market share and competitive advantages.

- Compare the company’s performance with its industry peers.

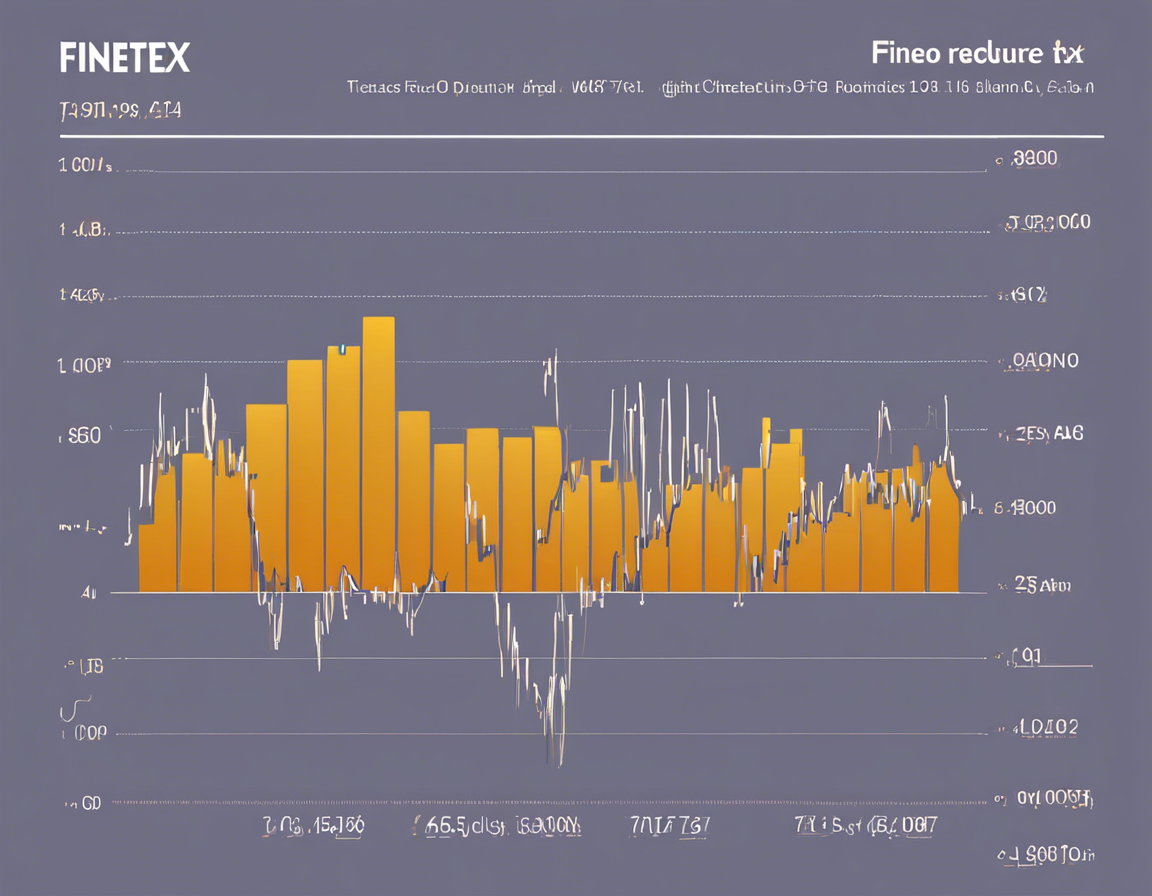

Technical Analysis of Fineotex Chemical Share Price Trends

Technical analysis involves studying historical price and volume data to identify patterns and trends that can help predict future price movements. When conducting technical analysis on Fineotex Chemical share prices, focus on the following aspects:

1. Chart Patterns

- Identify key chart patterns like support and resistance levels, trendlines, and breakouts.

- Use technical indicators such as moving averages, RSI, and MACD to confirm trend signals.

2. Volume Analysis

- Analyze trading volumes to validate price trends and breakout signals.

- Look for divergence between price movements and volume trends for potential reversals.

3. Trend Identification

- Determine the primary trend (uptrend, downtrend, or sideways) to align with the market direction.

- Use trend-following indicators to enter and exit trades based on price momentum.

Market Trends Impacting Fineotex Chemical Share Prices

Apart from company-specific factors, Fineotex Chemical share prices can also be influenced by broader market trends and macroeconomic conditions. Consider the following market trends that can impact the stock price:

- Industry Growth: Growth prospects in the specialty chemicals industry can drive Fineotex Chemical’s stock price.

- Regulatory Environment: Changes in regulations related to chemicals and environment can impact the company’s operations and profitability.

- Global Economic Conditions: Fineotex Chemical’s export business may be affected by global economic trends and currency fluctuations.

- Demand-Supply Dynamics: Shifts in demand for specialty chemicals and raw material prices can impact the company’s margins.

- Investor Sentiment: Market sentiment, news, and analyst recommendations can influence Fineotex Chemical’s share prices in the short term.

Frequently Asked Questions (FAQs)

- What is the current share price of Fineotex Chemical Limited?

-

The current share price of Fineotex Chemical Limited can be obtained from stock market websites or financial news portals.

-

How often should I analyze Fineotex Chemical share price trends?

-

It is recommended to conduct regular analysis, at least weekly, to stay informed about the stock price movements and make informed investment decisions.

-

What are some key financial ratios to consider when analyzing Fineotex Chemical’s stock?

-

Key financial ratios include price-to-earnings ratio (P/E), earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio.

-

How do industry trends impact Fineotex Chemical share prices?

-

Positive industry trends such as growing demand for specialty chemicals can boost Fineotex Chemical’s stock prices, while negative trends may lead to a decline.

-

Is Fineotex Chemical’s stock suitable for long-term investment or trading?

- This depends on your investment goals and risk tolerance. Conduct thorough analysis to determine if Fineotex Chemical aligns with your investment strategy.

In conclusion, analyzing Fineotex Chemical share price trends requires a comprehensive approach that combines fundamental analysis, technical analysis, and an understanding of market trends. By staying informed about the factors affecting the stock price, investors can make well-informed decisions and navigate the dynamic stock market with confidence.